Our Story

Elevate Credit Union Limited was founded in 1964 as Douglas Credit Union Limited to give monetary support to local people, protecting them from loan sharks who were rife throughout Douglas. The establishment proved to be popular and allowed people take control of their finances and gave them fair access to credit.

Douglas has changed a lot since then. However, the ethos of Elevate Credit Union has remained the same; to serve our members. Elevate Credit Union is unique in the sense that it is a not for profit financial institution, which works for its members. When you join Elevate Credit Union, you essentially become a part owner.

Due to a demand for services, a second branch was opened in Grange in 2007. This office has thrived over the past number of years, with a quarter of all our members coming from this area.

In 2016, Elevate Credit Union completed its first merger, joining with Passage West/Monsktown Credit Union. This move expanded the common bond, the area in which anyone living or working can become a member. Our common bond now stretches from Douglas to Ringaskiddy.

The primary function of Elevate Credit Union has always been to provide accessible financial services to our members. Due to progression within the commercial sector and member needs, we have altered and advanced our available services to stay relevant to members throughout the years. We constantly strive to provide our members with the best possible service and keep them at the center of everything we do.

How are Credit Unions Different?

Not-for-profit democratic financial cooperatives owned by members

When you join a credit union you are a member not a customer

Loans and savings are insured at no direct cost to an eligible member

No penalty for lump sum repayments or early loan repayments

Our Credit Union offers a number of services to the members

Current Account available with low and transparent fees

CUs are the organisations offering the best customer experience in Ireland

We’re digital when you want it, but human when you need it

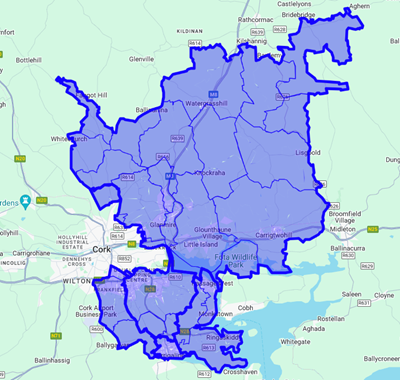

Our Common Bond

At Elevate Credit Union, our common bond is built on the shared community values and connections that bring people together. We’re proud to serve individuals who live, work, or have meaningful ties across our designated areas, which are listed below. Whether you’re a resident, an employee of a local business, or have family members who are already part of our credit union, you’re welcome to join our community.

Membership at Elevate Credit Union means access to financial services rooted in trust, cooperation, and a commitment to mutual success. Our common bond is more than a geographic connection—it’s a foundation that supports the financial well-being of all our members. Together, we’re building a stronger, more empowered community, one member at a time.

Douglas | Glanmire Village |

Passage West | Woodville |

Ringaskiddy | Ardbarra / Church Hill / Castlejane |

Shanbally | Glanmire Court |

Monkstown | Barnavarra Hill |

Grange | Lota |

Frankfield | Richmond (Townland) |

Donnybrook | New Inn |

Maryborough Hill | Eastcliffe / Glanmire Bridge |

Rochestown | Caherlag / Glounthaune / Windsor Hill |

Hazelwood / Glencairn | Little Island |

Riverstown / School Terrace / Riverstown Ballindenisk | Ballinglanna |

Springmount / Heatherview | Carberry Town |

Poulnacurry / Heatherview | Lacken Roe |

Ballincrossig | Glyntown |

Meadowbrook | Dunkettle |

Marble Park | Killacloyne / Kilcoolishal / Carrigtwohill |

St Joseph's View | Corbally |

Brookville | Brooklodge Grove / Brooklodge Square |

Watergrasshill / Glenville | Butlerstown |

Killydonaghue | Brookhill / Beechwood Avenue |

Templeisque | Ballyvinny |

St Stephen's Hospital | New Line / Coppervalley Vue |

Killalough | Brooklodge |

Sarsfield Court | Upper Glanmire |

Marwood / Riverview | Whites Cross / Carrignabhearr |

Oakfield | Ballyphilip |

Edenbrook Old Avenue / Orchard Manor | Coole East |

Riverstown Village | Knockraha |

Sallybrook / Elm Grove / Hayville | Leamlara |

Heatherview | Blossomgrove |

Willow Gardens | Rougrane |

Chestnut Meadows | Rathcooney / Knocknahorgan / Springhill |

The Hermitage / Barrymore Court | New Inn |

Richmond / Glenrichmond | Banduff |

Our Common Bond

A common bond is the area which we can accept new members from. You must live or work in our common bond to join Elevate Credit Union. Our common bond stretches from Douglas to Ringaskiddy, taking in Grange, Frankfield, Donnybrook, Maryborough Hill, Rochestown, Passage West, Monkstown and Shanbally. Click the button below to view our complete common bond map.

FAQs

Elevate Credit Union is a not for profit co-operative, whose members can save money with and borrow from them.

A common bond defines the area from which we can welcome new members. To join Elevate Credit Union, you must either live or work within this designated region.

Our common bond extends from Douglas to Glanmire, including:

📍 Grange, Frankfield, Donnybrook, Maryborough Hill, Rochestown

📍 Passage West, Monkstown, Shanbally

📍 Little Island, Knockraha, Watergrasshill

Curious if you're eligible? Check our common bond here.

Members are people who have an account with us.

The main benefit of being a member of Elevate Credit Union is that you are an owner of the credit union. We don't charge members maintenance fees for using our services. We also have Online Banking so members can access their account wherever they are. A full range of our services can be viewed here.

Shares are what we call savings. For example, every €1 saved is equivalent to 1 share in Elevate Credit Union. All shares are pooled together into a common fund.

A common fund is all the money that members have in savings. As the amount of shares builds up, the common fund grows. This is then available for providing loans to members. Saving regularly means that this pool grows and the amount available to members to borrow grows.

Every member over the age of 16 is entitled to nominate a person, or persons, to receive their shares in Elevate Credit Union should they pass on.

If you would like to become a member, you can find full details on joining here.