Opening An Account?

To become a member you must meet certain criteria e.g. live, work, study or attend school within our common bond. The following documents will be required to join:

- Photo ID - valid passport or driver's licence.

- Proof of Address - utility bill , bank statement or Government document dated within the last six months.

- Proof of working or studying in the area - Written confirmation on headed paper from Employer or College

To open an account for a minor under 16 the following documents will be required

to join:

- Birth certificate for the child.

- Childs Passport if available.

- Proof of Address - Parent(s) / Guardians(s) utility bill , bank statement or Government document dated within the last six months

- The child's P.P.S. number on an official document.

Benefits of Membership

Flexible loan repayment options and competitive loan interest rates

96% loan approval rate

Online banking and mobile app to access your account anywhere, anytime

Fast, friendly, efficient service from our dedicated staff

Three easily accessible branches with parking

We don't charge transaction fees for saving or borrowing with us

All members are invited to our AGM, where they have a say in how we are run

Monthly newsletter, keeping you up to date with what is happening in your CU

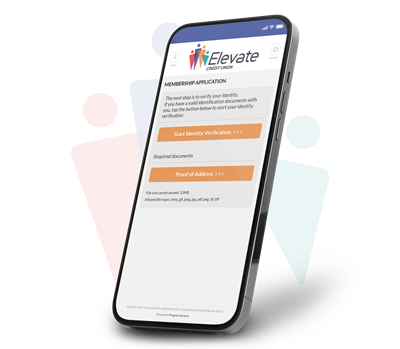

Join using your Phone

We’ve created an intelligent and secure method for you to become a member directly through your mobile phone. All you have to do is download our Mobile App to take full advantage of joining as you go.

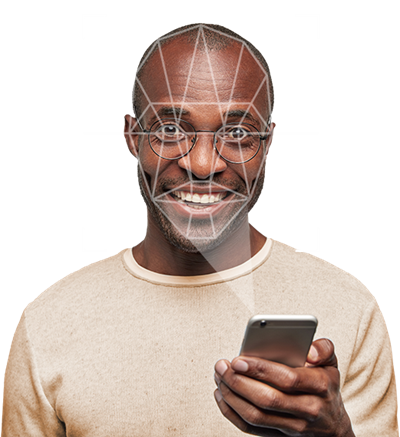

Secure Facial Verification

We use advanced biometric facial technology to capture and verify who you are. Simply take a quick selfie and you’re done. This intuitive technology, ensures becoming a member is quicker than ever.

Reliable Identity Check

We’ve created a way for you to share proof of ID with us that’s both secure and reliable. As you progress with your application, you will be given an opportunity to show your ID there and then. There’s no waiting around.

Quick Online Access

Once your membership has been approved, we'll text you a temporary pin so you can have immediate access to your online account. You won’t have to worry about anything, we will do the rest.

How to get started

Download our Mobile App

Make sure you have valid ID ready

Complete the form

Verify your Identity

Upload required documentation

Sit back and wait for us to review and approve your membership

More Info

Have you received a letter from us looking for up to date Membership Forms, photo ID and/or proof of your current address? Under the Criminal Justice Acts 2010 & 2013, Elevate Credit Union Ltd. is required to obtain documentary evidence to confirm a member's identity at their residential address.

Acceptable Photo ID: Current valid Passport, current valid Driver's Licence, current valid EU National ID card. Acceptable Proof of Address: Bank Statement, Utility Bill or letter from a Government Department, showing your name and address and dated within the past 6 months.

If you have received a letter from us requesting these documents, your account needs to be updated. You have a number of options to do this.

- Come to any of our three branches with the original document(s) where one of our Member Service Officers will make a copy of these and update your account.

- You can email a copy of the requested document(s) to info@Elevatecu.ie. Please include a short note requesting your ID to be updated. If you email these documents, YOUR PHOTO ID MUST BE IN COLOUR.

- Post a photocopy of the requested document(s) to Elevate Credit Union, Doulgas West, Cork. Please include a note requesting your ID to be updated. If you are posting these documents, YOUR PHOTO ID MUST BE IN COLOUR.

**Please note that where we cannot obtain the necessary documentation from a member, we are required by law to place restrictions and cease providing services on accounts. In order to avoid this scenario, we would greatly appreciate your cooperation with this request.

A Dormant Account is an account which the member has not used in the past 3 years.

If you receive a letter from us saying your account is dormant, there is no need to join again. You're still a member! When an account becomes dormant, it doesn't close - your savings stay in the credit union and continue to earn a dividend at the end of each year.

What Are My Options If My Account Is Dormant?

- Reactivate your account. Come to any of our three branches with valid photo ID (passport or drivers license), proof of your address (dated in the past 6 months) and proof of PPS (this is on your payslips, p60 or social welfare card). You also have to lodge or withdraw some money.

- Close your account. To do this, you need valid photo ID and proof of your address. You can then withdraw the money in your account and close it.

- Transfer your account to another credit union. If you have moved from the area and you would like to move your account closer to your new residence, contact the credit union in your new area to make the transfer.

The European Union (Payment Services) Regulations 2018 (the “Regulations)

This is your ‘Framework Contract’ with us in relation to the particular payment account referenced below and for the purposes of the Regulations.

This document relates to the Credit Union’s provision of payment services excluding current accounts, the terms of which are separate and available on the Credit Union’s website at www.elevatecu.ie.

Elevate Credit Union Limited is regulated by the Central Bank of Ireland.

Contact details for the Central Bank of Ireland are:

Address: New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3

Telephone: +353 1 224 6000

Fax: +353 1 671 5550

Website: www.centralbank.ie

CONTACT DETAILS FOR ELEVATE CREDIT UNION LIMITED

Address[1]: West Douglas,

Douglas,

Cork

T12 W950

Telephone: 021 4894555

Email: info@elevatecu.ie

Website: www.elevatecu.ie

Register Number: 46CU (the Central Bank’s register can be accessed on its website www.centralbank.ie).

Sub Office Details : Supervalu Shopping Centre, Grange, Cork

Chapel Square, Passage West, Cork

Crestfield Centre, Riverstown, Glanmire, Co.Cork

Our business days are as follows: Monday, Tuesday, Wednesday, Thursday, Friday & Saturday, excluding public holidays.

Monday to Friday 9.30am-5pm, Saturday 9.30-1pm.

YOUR ACCOUNT

The following is a description of the main characteristics of the account and payment services on the account:

· Lodging and withdrawing funds · Transferring funds internally to other accounts · Transferring funds out of a members account on foot of a EFT/Direct Debit either on a once off or a scheduled weekly/ monthly basis · Acceptance of funds transferred into member’s account by Direct Debit/Standing Order/EFT/Visa Debit card · Direct Debit outwards · One off electronic transfers of funds in/out of member’s account · Online banking via mobile banking application (available on Google Playstore or Apple App store), or via web portal. Members must register for this service. The services available include viewing access, internal transfers between members credit union accounts, SEPA transfers, Standing Order management, statement ordering, bill payment, loan application document upload, manage payees, update address · Payment of a utility/ bill from a member’s account or on foot of a withdrawal · Transacting business online |

- Giving an order for payment from your account: When you give us an order to make a payment from your account, we will need you to provide us with the details of the beneficiary of the payment (i.e. their account number and sort code, together with any relevant identification details for the payment service provider (‘PSP’) with which they hold their account). Depending on how you place your order with us (i.e. online, in our offices, by telephone etc) we may also need you verify that order by signature, by use of a password, or by use of a PIN, depending on the type of account that you hold. All of this information, taken together, is known as the ‘unique identifier’ that you must give us. In giving us that unique identifier, you will be consenting to our execution of that order for you. You cannot withdraw that consent after you have given it to us. However, if the order is for a direct debit to be taken from your account, you can revoke that order and your consent by notice to the beneficiary of that direct debit up to close of business on the business day before the funds are to be debited from your account. If the order is for a standing order to be taken from your account, you can revoke that order and your consent by telephoning us or calling into our offices up to close of business on the Business Day before the funds are to be debited from your account. In exceptional cases, we may allow you to withdraw your consent after the times specified above, but our specific agreement will be required and we will not be obliged to do this.

Elevate Credit Union now offers SEPA Instant Credit Transfers (SCT Inst). You can now receive SCT Inst payments into your accounts. In order for you to receive an SCT Inst payment your payer (the person making the payment to you) must send the payment through their Bank/payment service provider as an SCT Inst payment.

On or before the 9th of October 2025 Elevate Credit Union will be introducing outgoing SCT Inst payments from your accounts. This will allow members to make euro-denominated payments within 10 seconds across SEPA-participating financial institutions. These transactions can be executed 24/7/365, including weekends and holidays. To use SEPA Instant, members must provide the recipient’s IBAN and confirm transaction authorisation through online banking or in-office verification.

- Cut-off times: When we are given an order in relation to a payment on your account, we must be given that order before 12p.m on one of our business days (excluding Saturdays). If we are given that order after that time, we will be deemed to have received that order on our next following business day. If we agree with you that an order is to be executed on a particular business day, then we will be deemed to have received that order on that particular business day.

While standard SEPA credit transfers must be initiated before 12.00 PM on a business day (excluding Saturday) for same-day processing, SEPA Instant transactions will not have cut-off times and are processed immediately.

- Execution times: We confirm that we have up to the end of the first business day following the date of deemed receipt under 2 above to so credit that amount. If the order is initiated by paper, in both cases we will have an extra business day to do this.

- Standard SEPA Credit Transfer: Funds are credited to the beneficiary’s Payment Service Provider (PSP) by the end of the next business day.

- SEPA Instant Credit Transfer: Transactions are completed within 10 seconds, ensuring real-time payment availability.

- Spending limits and payment instruments: If we give you a payment instrument on your account (i.e. a card with a PIN number, or use of online banking with a password, you may separately agree spending limits with us for use of a particular payment instrument. If we give you such a payment instrument for your account, you must, as soon as you receive it, take all reasonable steps to keep personalised security credentials safe. If the payment instrument is lost, stolen, misappropriated or used in an unauthorised manner, you should notify us by calling our main office on 021 4894555 immediately. We reserve the right to block your use of a payment instrument for any of the following reasons:

- the security of the payment instrument;

- if we suspect that it is, or has been, used in an unauthorised or fraudulent manner;

- (if the payment instrument is connected with the provision by us of credit to you) a significantly increased risk that you may be unable to fulfil your obligations to pay; and

- our legal or regulatory obligations, including our national or European Union obligations.

If we block your use of a payment instrument, we will tell you about it (and the reasons for it) by contacting you on the contact number provided by you to us, attached to your account unless giving you that information would compromise our security or would be prohibited by law. You may request that we unblock the payment instrument, and we will do so, or replace the payment instrument, once the reason for blocking no longer exists.

The maximum limit for a SEPA Instant Credit Transfer is €100,000 per transaction. Members can set personal transaction limits through online banking or in-office service requests.

- Charges: Currently accounts offered by Elevate Credit Union Ltd do not incur charges.

- Interest rates: If an interest rate applies to your account, you are told this when you open your account and that interest rate is incorporated by reference into this Framework Contract. You can obtain confirmation of that interest rate by contacting us as set out on page 1 above.

- Exchange rates: If any payment on your account (including a withdrawal by you from your account) involves a currency conversion being made by us, we will use a reference exchange rate that is determined by FEXCO international payments (the ‘reference exchange rate’). The reference exchange rate will change daily and this is the basis on which we will calculate the actual exchange rate. On the date on which we effect the currency conversion, we will take the reference exchange rate that applies on that date, add a fixed amount of the following:

Transaction Type | % | Minimum | Maximum |

Buy Foreign Note | 2% | €1.50 | €15.00 |

Sell Foreign Note | 1% | €1.00 | €15.00 |

Buy Foreign Cheques | 2% | €1.50 | €15.00 |

the total will equal the actual exchange rate that is used by us in the currency conversion. You can find out changes to the reference exchange rate by contacting us as set out on page 1 above.

SEPA Instant transactions are processed in EUR only. If a cross-currency transfer is required, it will be processed using standard SEPA credit transfer rules, subject to applicable exchange rates and conversion times.

- Giving you information: If we need to communicate with you, give you information or notice of any matters relating to this Framework Contract, we will do so in writing or by placing a notice in writing in our office and on our website. Such information or notice will be given to you promptly upon the requirement to do so arising. You may request that we provide or make available to you certain information (prescribed by law) relating to individual payment transactions executed on your account at least once a month and free of charge, in a manner that allows you to store and reproduce the information unchanged.

- Copy Framework Contract: For as long as you hold this account with us, you have the right to receive, at any time and on request by you, a copy of this Framework Contract on paper or, if possible, by secure email.

- Unauthorised transactions: If you become aware of a transaction on your account that is unauthorised or incorrectly executed, or if your payment instrument is lost, stolen or misappropriated, you must tell us without undue delay and, in any event, within thirteen months of such a transaction being debited from your account. You will be entitled to rectification from us if that transaction was unauthorised or incorrectly executed. If the transaction was unauthorised, we will refund the amount of it to you and, if necessary, restore your account to the state that it would have been in if the unauthorised transaction had not taken place PROVIDED THAT:

- you will bear the loss of an unauthorised transaction on your account, up to a total of €50, if the unauthorised transaction resulted from the use of a lost, stolen or misappropriated payment instrument unless (i) the loss, theft or misappropriation was not detectable to you prior to the payment and you have not acted fraudulently, or (ii) the loss was caused by actions or lack of action by us or any of our employees, agents or third parties acting on our behalf.

- you will bear all losses relating to an unauthorised transaction on your account if you incurred those losses by acting fraudulently or by failing, intentionally or with gross negligence, or if you failed to take all reasonable steps to keep the payment instrument and personalised security credentials safe, to use the payment instrument in accordance with any terms that we tell you are applicable to it, and to notify us without undue delay of it being lost, stolen, misappropriated or used in an unauthorised manner;

- so long as you have not acted fraudulently you will not bear any financial consequences resulting from the use of a lost, stolen or misappropriated payment instrument once you have notified us in accordance with this Framework Contract that it has been lost, stolen or misappropriated;

- if we have not required strong customer authentication, in accordance with applicable legal or regulatory standards, you will not bear any financial losses unless you have acted fraudulently.

- Refunds of direct debits: If a direct debit is taken from your account but:

- your direct debit authorisation did not specify the exact amount of the payment; and

- the amount of the payment exceeded the amount you could reasonably have expected taking into account your previous spending patterns, this Framework Contract and other relevant circumstances; and

- you give us such factual information as we may require; and

- you did not give us consent in advance to the direct debit being taken from your account; and

- neither we nor the beneficiary of the direct debit made information available to you about the transaction at least four weeks before the debit date,

then you may request a refund from us of that direct debit for an eight week period following the debit date. We will then have ten Business days to refund you, or give you reasons for our refusal to refund you and that your right to refer the matter to the FSPO, see clause 17 below for further details.

- Unique identifier: If you give us an order to make a payment from your account and we execute it in accordance with the correct unique identifier, we will be taken to have executed it correctly as regards the beneficiary of that order. If you give us an incorrect unique identifier, we will not be liable for the non-execution, or defective execution, of the order. We will, however, make reasonable efforts to recover the funds involved.

To process a SEPA Instant Credit Transfer, members must provide the recipient’s International Bank Account Number (IBAN). This is the unique identifier required to ensure the correct execution of the payment. If an incorrect IBAN is provided, the transaction may be rejected or misdirected, and recovery efforts will follow standard non-execution procedures

- Our liability if you make a payment out of your account: If you give us an order to make a payment from your account, we are liable to you for its correct execution unless we can prove to you (and if necessary to the beneficiary’s PSP) that the beneficiary’s PSP received the payment. If we are so liable to you for a defective or incorrectly executed order, we will refund the amount of it to you and, if applicable, restore your account to the state that it would have been in if the defective or incorrect transaction had not taken place. Irrespective of whether we are liable to you or not in these circumstances, we will try to trace the transaction and notify you of the outcome. If we refuse to execute a payment transaction we will provide the reasons to you and the procedure for correcting any factual mistakes that may have led to the refusal unless prohibited by law or regulatory requirements.

- Our liability if you receive a payment in to your account: If the payer’s PSP can prove that we received the payment for you, then we will be liable to you. If we are liable to you we will immediately place the amount of the transaction at your disposal and credit the amount to your account. If you have arranged for a direct debit to be paid into your account, we will be liable to transmit that order to the payer’s PSP. We will ensure that the amount of the transaction is at your disposal immediately after it is credited to our account. If we are not liable as set out above, the payer’s PSP will be liable to the payer for the transaction. Regardless of whether we are liable or not, we will immediately try to trace the transaction and notify you of the outcome.

- Duration, changes and termination: Your contract with us, as detailed in this Framework Contract, is of indefinite duration. If we want to change any part of the information provided herein which is required by Regulation 76, we will give you at least two months’ written notice of the proposed change where required by law to do so. If you do not notify us within that two month period that you do not accept the proposed change, you will be deemed to have accepted it. If you do not want to accept the proposed change, you must notify us in writing and you will be allowed to terminate your contract with us in relation to the account to which this Framework Contract relates immediately and without charge before the end of that two month period. If we change an interest rate or an exchange rate in a way that is more favourable to you, we have the right to apply that change immediately and write to you soon afterwards confirming that change. We can change an exchange rate immediately and without notice if that change is based upon the reference exchange rate agreed in this Framework Contract. You may terminate your contract with us in relation to the account to which this Framework Contract relates on one month’s notice in writing. We may terminate our contract with you in relation to the account to which this Framework Contract relates on giving you two months’ notice in writing.

If a SEPA Instant Credit Transfer is received into a member’s account, Elevate Credit Union will ensure that funds are immediately credited and available for use, in accordance with EU Regulation 2021/1230. If there are any delays due to system outages or security checks, the Credit Union will notify the affected member immediately.

- Security and Fraud Prevention Measures: Due to the irreversible nature of SEPA Instant transactions, Elevate Credit Union has implemented enhanced fraud detection and monitoring measures. Members are encouraged to verify recipient details before initiating a SEPA Instant transfer, as unauthorised transactions may not be recoverable. For further details regarding SEPA Instant payments and compliance with PSD2 and SEPA Scheme Rules, members can contact our support team or visit the Credit Union’s website.

- Governing law and language: This Framework Contract shall be governed by and construed in accordance with the laws of Ireland, and all communication between us and you during our contractual relationship shall be conducted in English.

- Redress: If you have a complaint in relation to the matters governed by this Framework Contract you can write to us, and we will deal with your complaint in accordance with our obligations under the Regulations. If you are not satisfied with the outcome of this internal process, you may refer your complaint to the Financial Services and Pensions Ombudsman. Contact details are as follows: Financial Services and Pensions Ombudsman, Lincoln House, Lincoln Place, Dublin 2 D02 VH29. Tel. (01) 567 7000, E-mail: info@fspo.ie

- Consent: By maintaining and/or carrying out transactions on this account, you explicitly consent to us accessing, processing and retaining personal data necessary for the provision of these payment services.